Strategic and Financial Advisory

A multi-dimensional transformation taking place today is fundamentally changing the ways in which electric, gas, and water utilities plan, operate and interface with their customers. Our clients are feeling the impacts from increased penetration of distributed energy resources, the wide variety of options for smart grid technologies, an evolving role for natural gas, complex regulatory requirements, and expanding customer expectations for new and innovative products and services.

Through our consulting assignments, MCR helps our clients navigate challenges and opportunities they face and understand them from an investor’s perspective and create opportunities to increase value for their customers, shareholders and other key stakeholders. We achieve this by developing customized strategies that are both manageable and executable.

Key Staff

Sam Brothwell, Vice President

Sam is Vice President of Strategic and Financial Advisory. Sam’s background includes a decade in utility industry corporate planning and investor relations, fifteen years on Wall Street as a senior equity and credit financial analyst and nearly a decade as a utility and pipeline investor. His background includes electricity, natural gas, and renewable energy. Sam has worked extensively with federal and state policy makers as well as non-government organizations involved in the energy and utility sectors, and he has spoken at numerous industry conferences and investment forums.

![]() Visit Profile

Visit Profile

Insights

- Why Can’t We Be Friends? Gas and Electricity Can Meet Energy Challenges Together

- DeepSeek, or Deep Fake? Data Center Challenges and Opportunities for the Power Industry

- Utility Cost Management—A Strategic Approach

- Utility Headwinds Call for Smart Cost Management

- The fallout from the SVB event and how utility financial professionals should respond (Point-of-View)

- Stove wars—is natural gas part of the problem or part of the solution? (white paper)

- Cutting Carbon and Adding Renewables May Not Win ESG Points

- Now for the Hard Part – Growing Your Utility without the Triple Two’s (white paper)

- Investor Perspectives on Natural Gas Utilities

Key Staff

Participating in a National Standard Practice Manual Stakeholder Process

Recently, staff of MCR’s Regulatory Services practice joined staff from the Energy Products and Services practice in participating in a National Standard Practice Manual (NSPM) stakeholder process as an independent subject matter expert. In the brief case study, MCR shares perspectives on the cost-effectiveness test development process, mandated by the jurisdiction’s regulatory body, from our utilities-only lens.

Why Can’t We Be Friends? Gas and Electricity Can Meet Energy Challenges Together

Utilities today are challenged to deliver reliable, resilient, affordable, and clean energy against a backdrop of high interest rates, inflation, and increasingly hostile weather. Rather than “gold-plating” to address peak loads and tail risks, utilities might better serve their customers by working together to optimize use of built-and paid-for gas and electric delivery infrastructure.

Ian Richter, Consultant

![]() Visit Profile

Visit Profile

The Growing Imperative for Natural Gas Energy Efficiency – American Gas Foundation

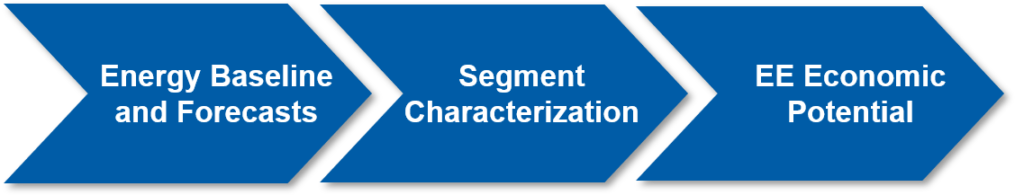

The American Gas Foundation (AGF) engaged MCR to evaluate the full range of current and future potential benefits that could accrue from natural gas utility energy efficiency (EE) programs, including 1) the current state of gas utility EE cost-effectiveness, and 2) perspective potential future benefits. The report provides an in-depth survey of existing natural gas utility EE programs as well as potential future program approaches and incentive strategies. The study also highlights opportunities to leverage indirect and non-energy benefits stemming from optimal and efficient use of natural gas delivery infrastructure.

DeepSeek, or Deep Fake? Data Center Challenges and Opportunities for the Power Industry

Artificial intelligence–and the power-hungry data centers that run it—dominated utility investor dialog last year. The power sector has decades of experience with shiny new sources of electricity demand—and the scars to prove it. Supply is being built, and the data centers are coming…but it’s fair to ask if they’ll all stick around.

Investor Perspectives on Natural Gas Utilities

The American Gas Association (AGA) and the Canadian Gas Association (CGA) commissioned MCR Performance Solutions LLC (MCR) to update and enhance their 2022 study, “Investor Expectations on North American Gas Utilities.” MCR found that while the gas utility industry’s underlying commercial foundation remains solid, regional policy challenges coupled with rapidly growing energy demand (and the urgent imperatives of affordability, security, resilience, and reliability) suggest there is potential in considering new commercial avenues—avenues that can both sustain a mature industry and align business strategies with important public policy and social objectives.

Read the Investor Perspectives on Natural Gas Utilities

Is your Nuclear Plant Capitalizing All the Costs you’re Entitled to?

Reducing O&M costs is one of the highest priorities for nuclear generation executives today. Often overlooked, however, are project expenditures. A nuclear generation plant incorporates numerous interdependent pieces of equipment and components, and it can be difficult to identify whether items constitute discrete units of property (UoP), major components or something else.

Read the Nuclear Generation Services Insight

Cash Working Capital and Lead-Lag Studies

In the evolving regulatory landscape, utilities across the electric, gas, and water sectors are facing increasing scrutiny from regulators who are demanding more detailed calculations of cash working capital. This requirement reflects a broader push for greater accuracy in the financial management of utilities, ensuring that rates charged to customers are fair and reflective of actual operational needs. Our team understands the complexities of cash flow management and the regulatory environment, ensuring that your utility’s cash working capital is calculated accurately and efficiently.

Read the Cash Working Capital and Lead-Lag Studies Insight>>>

Nikhil Tarlapally, Lead Consultant

John Simpsen, Lead Consultant

![]() Visit Profile

Visit Profile

Dylan Robideaux, Lead Consultant

![]() Visit Profile

Visit Profile

Ted Konstantino, Associate Consultant

Wale Adeyinka, Lead Consultant

![]() Visit Profile

Visit Profile

Rate Case Services

MCR develops solutions to key issues facing utility executives. MCR works with you and your stakeholders to provide solutions that work in your regulatory jurisdictional environment. Our industry experts assist electric, natural gas and water companies.

Read the Rate Case Services Insight>>>

How MCR Helped an Electric Utility Develop and Implement a New Cost of Service Model

Background

The electric IOU Public Service Company of New Mexico (PNM) faced a number of challenges with its cost of service model. Intervenors struggled to understand the model during rate cases, slowing down the regulatory process. The model wasn’t user friendly and was difficult to master. In addition, it was proprietary, so if changes were required, PNM had to go back to the vendor to implement them. A new cost of service model was needed to meet the utility’s internal needs and make the regulatory process more efficient. So PNM reached out to MCR, both for our customizable cost of service model and our specialized expertise.

Approach

MCR’s Cost of Service Tool (COST™) is unique to the industry and features transparent formulas, an automated import tool, and an integrated rate design module. Further, the COST™ license allows for companies to take full control over the model once implementation is complete if they desire.

PNM chose to retain MCR to implement the COST™ model and assist them with their first rate case after implementation. Our team developed a 12-week implementation timeline to adapt the modular COST™ model for PNM, using the company’s prior cost of service study as a guide. This assured them that when the COST™ model was finalized it would fit within the regulatory guidelines required by their jurisdictional authority. Throughout the implementation process, MCR compared the COST™ model with prior studies to ensure that the outputs of the two models were similar. Where differences were found, we worked with PNM to determine how they would be addressed in the new model.

For greater efficiency, the COST™ model’s rate design module was implemented at the same time as the cost of service portion. MCR worked with the PNM team to adapt their inputs to the COST™ model’s data import tool, so that data in subsequent runs of the model could be inputted quickly and accurately. Throughout the process, MCR held frequent check-in meetings with our clients, keeping them informed, soliciting their feedback, and providing them with hands-on training to ensure that they were familiar with the model and could run it on their own. Documentation was also provided, customized to PNM’s version of the COST™ model.

During the rate case, PNM asked that MCR work on an accelerated timeline, developing the COST™ model for the requested test year and designing the proposed rates in just one month. Our team updated the COST™ model and its attached rate design module with current and prospective data. We ran multiple studies for PNM and worked with our clients and their leadership team to develop multiple rate design scenarios. We assisted in drafting testimony and worked with our clients to prepare all the exhibits needed for filing and handled subsequent data requests once the case had commenced. We also provided training for the intervenors in the case, enabling them to develop alternative studies and rate designs within the same model.

Results

MCR’s COST™ model was accepted by PNM’s commission, and the sole intervenor’s objections to the model were rejected. PNM called the COST™ model “very easy to use,” adding, “We were able to pull the numbers seamlessly and easily.” Intervenors found the models easy to understand as well. Once trained, our clients had a few questions for clarity, but they were able to make the necessary changes on their own.

PNM has now retained MCR for a subsequent rate case. We updated the COST™ model with new enhancements that have been added since their first rate case. Using the training provided by MCR, PNM is completing the COST™ model and its rate design module on their own this time, calling on our team to assist as needed.

Download Client Story as a PDF >

No Time To Waste In Filing for Transmission Rate Incentives

The Midcontinent Independent System Operator (MISO) is undergoing the most ambitious transmission expansion in its history. This process, called Long-Range Transmission Planning (LRTP), consists of four project portfolios, or tranches. In July 2022, the MISO Board of Directors approved the first tranche of transmission solutions developed to provide reliable and economic energy delivery to address future reliability needs. Tranche 1 includes 18 projects, also referred to as LRTPs, with an estimated cost of $10.3 billion. These 18 projects are in the MISO Midwest Subregion and include more than 2,000 miles of transmission lines.

Download the Transmission Hot Topic

Case Study: Cost-Effectiveness Analysis for EV Programs

Utility Cost Management—A Strategic Approach

Cost management and budgeting in the utility industry are often based on prior year actual numbers and activity, without questioning why specific line items need funding, or evaluating the risk of not funding or carrying out a particular project or activity in a given year. MCR’s nuclear practice has developed a proprietary, strategic approach to facility-wide cost management, capital project evaluation, and capitalization vs expensing decisions with demonstrated savings in the hundreds of millions of dollars. This strategic approach is outlined in our most recent whitepaper.

Lessons Learned from the Rate Case Process

As utilities find themselves in need of increased revenue, it is important to evaluate lessons learned from prior rate case proceedings so the next rate case will be more successful. This paper focuses on lessons learned in four areas: 1) understanding the regulatory process, 2) employing stakeholder engagement, 3) confirming data integrity, and 4) leveraging staff’s experience to ensure rate case needs are met.

How MCR Helped a Southern IOU Develop a Green Energy Tariff as Part of Securing Renewable Load

Background

A Southern vertically integrated electric company was signing a power purchase agreement (PPA) to secure renewable load. As part of that process, they wanted to know whether a specific tariff for renewable energy would be acceptable to both customers and regulators, and whether it made business sense for the company to pursue for this renewable load. The company needed help investigating green tariff options. Having used MCR to conduct other research and analysis projects, they called on MCR to research and propose suggestions for a green tariff.

Approach

Our client wanted to understand what tariff option would be best for its customers to use under this renewable PPA. So MCR conducted an extensive study of the markets for green tariffs and renewable energy credits (RECs) locally and regionally, leveraging research already completed by the utility. We developed a presentation for senior management describing the basics of RECs and green tariffs, as well as green tariff offerings utilized by utilities in their region and in the rest of the United States.

MCR also researched the local jurisdictional authority, examining the dockets, testimony, and orders for other local utilities that had already implemented green tariffs. This information was consolidated to give a complete but summarized view of the regulatory climate for green tariffs. For the utility’s jurisdiction, we were able to show which green tariff options had been successfully implemented, the outlook given by the regulators and their staff on green tariff options, how the local REC market would affect the choice made by the utility, how RECS were accounted for, and what customers were specifically looking for from a green tariff.

Based on this research, we focused on four types of green tariffs that are commonly used and accepted by regulators and customers.

- Green Power Products. The utility procures renewable energy for customers who select this option, either through new construction or on the open market. These customers pay a premium on top of their normal bill to cover the cost of both the renewable energy and the administrative costs of the program.

- Sleeved PPA Services. Utility customers enter into a PPA with a renewable energy provider. The utility handles the transfer of money and energy to and from a renewable energy project on behalf of the buyer. If the energy does not cover the buyer’s needs, the utility is responsible for supplying the additional power. The customer either pays a premium or receives a discount on their normal electric supply charges, depending on the terms of the

PPA. - Subscription Services. The utility procures renewable energy for its customers, either through new construction or on the open market. The procured energy is divided into blocks of capacity or facility output, which are sold to customers at a fixed price. Customers receive a credit on their utility bill for energy provided by their subscribed number of blocks.

- Virtual PPA Programs. This type of tariff is normally utilized by renewable developers. Customers enter into multi-year bilateral energy contracts to pay for the energy produced by the developer at a fixed price. The developer then sells the energy on the open market. The difference between what the energy was sold for and what the customer paid for the energy is either credited to or subsequently charged to the original customer.

Results

MCR recommended that this IOU move forward with a green power product, as these products are the easiest to implement, are most accessible to all customers, and have a proven track record in our client’s jurisdiction. The client accepted MCR’s recommendation and is expected to file the green tariff once other regulatory priorities are resolved.

Download Client Story as a PDF >

Utility Headwinds Call for Smart Cost Management

As third quarter earnings reports begin, utility results will be scrutinized for hints of slowing growth against a backdrop of higher interest rates and upward pressure on labor and other costs. The likelihood of “higher for longer” points up a need for a strategic and sustainable approach to cost management.

SECURITIZATION: A Valuable Tool for Cost Recovery Opportunities Outside a Normal Rate Case

In recent years, a flurry of legislative activity has addressed utility securitization. Seventeen states have passed legislation offering securitization options to their electric utilities in the last decade, and several other states have proposed similar legislation. Securitization, while not a new concept, has been a successful tool for utilities to improve cost recovery while saving customers money on their electric bills. In this paper, we analyze trends in securitization legislation and detail the options that may work for your utility.

Read the securitization white paper>>>

Five Key Strategic Considerations for the Utility Regulatory Process

Of the many business functions unique to utilities, the process of setting rates is probably the most arcane and least understood by those outside the industry. While developing a financial model in support of a given tariff is relatively straightforward and formulaic, implementing it in the rate-setting process comes with myriad subtleties. The state-level regulatory context typically involves a quasi-judicial process and multiple constituents with different and often competing motivations. This paper examines some strategic considerations associated with the rate-setting process, highlighting the importance of the utility’s regulatory relationships.

Transmission Investment Analysis

With the recent surge in transmission investment being proposed, our cooperative, public power, and independent developer clients are all asking the same two questions: I know investing in transmission tends to be good, but how much value does it really provide for our members/ customers/owners, and how do I manage the risk?

Download Transmission Investment Analysis Insight

Modern Electric Vehicle Rate Design Options

Electric vehicle (EV) sales increased dramatically in 2022, with more than 750,000 new all-electric cars registered in the United States – a 55% increase over 2021 sales. Although forecasts vary widely, many analysts expect strong acceleration in EV adoption. Some analysts forecast EVs could represent 50% of total U.S. passenger car sales by 2030.

If growth rates to 2030 are even close to those projected, electric distribution systems will face massive challenges as most are not equipped to handle the increased load. One effective action utilities can take is to design tariffs to manage the charging load, fairly recover costs, and empower customers with flexible rate alternatives. To better understand these pricing solutions, we identified and analyzed several modern EV rate designs and explored how to implement them.

This white paper is Part 2 of the series, “Is Your EV Strategy Ready – Yet?

Modern Electric Vehicle Rate Design Options

Electric vehicle (EV) sales increased dramatically in 2022, with more than 750,000 new all-electric cars registered in the United States – a 55% increase over 2021 sales. Although forecasts vary widely, many analysts expect strong acceleration in EV adoption. Some analysts forecast EVs could represent 50% of total U.S. passenger car sales by 2030.

If growth rates to 2030 are even close to those projected, electric distribution systems will face massive challenges as most are not equipped to handle the increased load. One effective action utilities can take is to design tariffs to manage the charging load, fairly recover costs, and empower customers with flexible rate alternatives. To better understand these pricing solutions, we identified and analyzed several modern EV rate designs and explored how to implement them.

This white paper is Part 2 of the series, “Is Your EV Strategy Ready – Yet?

Cutting Carbon and Adding Renewables May Not Win ESG Points

Switching from coal to natural gas and renewables has made the power sector a leader in cutting US carbon emissions. But adherence to a strict environmental, social, and governance (ESG) diet would deny capital to the very sector that’s doing the most good.

With Criticality achieved, the Nuclear Industry is more important than ever

Nuclear generation is the largest and most reliable source of carbon-free, around-the-clock electricity. While this idea is gaining environmental and mainstream recognition, we believe more needs to be done to economically compensate nuclear for its increasingly crucial role in maintaining grid reliability.

Energy Efficiency: Today’s Silver Bullet For Gas Utilities

Now more than ever, MCR has found in its current and recent work that gas utility energy efficiency products and services are a strategic opportunity, perhaps a strategic imperative, for local distribution companies (LDC). Gas energy efficiency is an impactful tool in the LDC’s load growth and retention toolbox. Also, as the influence of ESG on cost of capital, shareholder activism, and state and federal policy increases, gas energy efficiency is a big part of improving ESG scores and demonstrating a positive impact on energy and environmental justice priorities.

Point of View: Gas Energy Efficiency for Strategic Load Growth & Retention

It is time for gas companies to ask themselves a critical question: Can gas energy efficiency programming be used as a strategic opportunity to grow and retain load? Customer-funded natural gas energy efficiency (EE) spending via utility EE programs has risen from approximately $300 million per year in 2006 to over $1.5 billion today. Largely as a regulatory compliance obligation. The current focus on electrification, and other market and political dynamics, create a strategic imperative for gas utilities to reexamine energy efficiency products and services.

In this Point of View piece, exclusively for gas utilities, MCR’s Ed Schmidt discusses use of energy efficiency to maintain and even grow natural gas load.

Cooperatives Gaining Substantial Benefits for Renewable Investments

The Inflation Reduction Act has designated billions of dollars to support cooperative development of renewables. Our analysis show how coops now have viable options to develop their own projects

Download the Cooperatives Benefits white paper

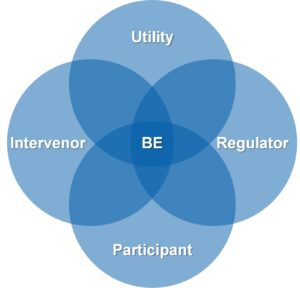

Beneficial Electrification: A Smart Strategy Makes the Difference

Utilities nationwide are launching beneficial electrification (BE) initiatives, both to respond to market and policy evolutions and to enhance the growth of their electric business. Success begins with a well-thought out strategy.

Download Beneficial Electrification Insight.

Benefical Electrification: A Smart Strategy Makes the Difference

Utilities nationwide are launching beneficial electrification (BE) initiatives, both to respond to market and policy evolutions and to enhance the growth of their electric business. Success begins with a well-thought out strategy.

Download Benefical Electrification Insight.

Reconcile Safety & Reliability Cost

MCR assists nuclear plants by teaching techniques to prepare robust business cases with creative alternatives, quantifying reliability and financial risk. With this information, the Executive Review Team is empowered with previously unavailable insights to confidently make the best decisions.

Cost Reduction through Risk-Informed Budgeting

As part of an overall effort to inject more rigor into the development of their Operations & Maintenance (O&M) budget, a top-10 integrated utility in the Southwest sought to engage a firm with extensive experience in providing consulting services in zero base budgeting (ZBB) for utilities.

Developing a Strategic Business Plan for a Cooperative (Strategic Economic Analysis)

“This Transmission Business Strategy was a great opportunity to get in front of our Board of Directors and our senior staff and do an education piece on the key industry issues, but also to inform them of our transmission strategies. I’m very happy with how it turned out.”

—Vice President of Transmission, Cooperative

Background

A Midwestern cooperative was faced with increased interconnection requests and wanted to ensure that its transmission OATT and rate formula was equitable and in line with general FERC and industry practices. Moreover, the client wanted to ensure that its transmission-related costs and appropriate return were recovered. Ensuring the cost recovery formula was consistent with industry practices was particularly important given the company was faced with multiple staff retirements, including accounting positions who would be responsible with updating the formula rate.

In addition, the company wanted to develop a Transmission Business Plan to transition it from a company that largely views the Transmission function as an operational necessity to one that views Transmission as a business that actively can contribute substantial revenue and value for its member-owners. This strategic transition was particularly timely given the transmission business function had new management and staff.

Solution

In Phase 1, MCR reviewed the clients’ interconnection and grandfathered agreements and identified ways to revise its interconnection policies to ensure alignment to typical RTO policies. We then conducted a transmission formula rate review to identify potential improvements in how costs are recorded and how transmission revenue can be optimized. In Phase 2, MCR led a senior client working team through multiple meetings to develop a five-year Transmission Strategic Business Plan. Our approach included identifying and prioritizing key transmission industry issues/trends and methods for creating member value, and developing a vision, objective areas and strategies. It also included identifying transmission project opportunities for improving member reliability and creating financial value. We used MCR’s Transmission Project Evaluation Tool™ to conduct a financial analysis of one potential project. We also incorporated investment metrics from MCR’s Proprietary Transmission Investment and Load data base into the analysis to compare the client’s rate of transmission investment to its peers. The results of the Transmission Strategic Business Plan, including an education session on key industry issues were presented to the senior management team and the Board.

Results

The client made changes to its OATT and interconnection policies to more closely align with continuing changes to standard industry approaches in order to proactively address any potential interconnection customers’ issues. Based on the transmission formula rate review, the company is considering making changes to how some costs are recorded, thus improving its annual transmission revenue requirement (ATRR) by 5%. The client is moving forward with its Transmission Business Plan, including implementing about 18 high priority strategies that address the top issues, and create value for its members through reliability improvements, better access to additional resources, or enhanced transmission revenue from third parties. Lastly, the client management, Board and staff are better educated on industry issues, allowing for improved decision-making, consistent with their vision and strategies.

FERC Filing Support – Supporting Public Power and Cooperatives in Transmission FERC Filings (Brochure)

MCR supports clients in transmission FERC filings in:Transmission incentive rate filings, Section 205 rate filings involving cost of capital testimony and formula rate support, and intervention and settlement support.

You must be logged in

Stove wars—is natural gas part of the problem or part of the solution? (white paper)

Natural gas has emerged as arguably the world’s most critical source of energy, but the industry seems to be battling for its own survival in the face of environmental activism and local attempts to ban its use. In our view, the gas industry needs to emphasize the role it plays not only in the transition to cleaner fuels, but in assuring the reliable delivery of all forms of energy, including electricity.

Strategic Business Planning for Transmission Owners

MCR works with clients to develop strategic business plans for transmission owners that set them up for success. These actionable plans address key transmission issues and help utilities transition to running transmission as a business rather than merely an operational necessity.

Read Strategic Business Planning for Transmission Owners

The fallout from the SVB event and how utility financial professionals should respond (Point-of-View)

Over the past few weeks, business news headlines have been overwhelmed by echoes of the 2008 and 2020 financial crisis. Utilities are highly capital-intensive and rely on banks, particularly for short-term financing; should they be concerned about recent events?

Now for the Hard Part – Growing Your Utility without the Triple Two’s (white paper)

U.S. utilities have enjoyed a decade of capital investment that is delivering greater reliability and efficiency for customers, strong returns for shareholders and lower environmental impacts for all. Looking ahead, the industry faces a generational investment opportunity in a transitioning energy world, but in our view, execution risk is rising. Why?

Client Stories

MCR’s Strategic and Financial Advisory practice works with electric, natural gas and water utilities. They include Investor-Owned utilities, Generation and Transmission Cooperatives and Municipal and Public Power companies.

Please visit our website in the coming months to receive updates on our latest client success stories.

Insights

What we do

Finance and Investor Relations

MCR helps our clients better understand capital markets and what’s driving their company’s stock. We provide expert analysis on ownership changes, valuation, dividend policy, peer ownership, analyst recommendations, and market trends. We provide informed investor targeting and activist surveillance. We support investor and board communications ranging from press releases to presentation materials to board and investor events, helping to clearly communicate strategy, goals, and execution.

Corporate Planning

MCR evaluates strategic options ranging from business line and product ideas to merger, acquisition, and divestiture proposals as well as financing alternatives from a non-transactional point of view. We help our clients evaluate potential changes to business models and regulatory compensatory systems and structures as the utility landscape evolves. We help develop cost-effective solutions to meet changing consumer expectations, regulatory and policy initiatives, rising costs, and incorporation of new technologies and business practices.

Natural Gas and Electric Strategies

We work with senior management to evaluate specific projects or business and regulatory tactics, analyze legislation and regulatory / policy actions. We provide assistance in developing strategic positioning for natural gas utilities, their role in decarbonization and support for electric utility reliability. For electric utilities we offer assistance in addressing electrification, EV’s, renewables and storage.

Regulatory and Finance

We partner with MCR’s Regulatory practice to provide superior solutions in regulatory and finance, advising on equity and credit market capital formation, cost of capital, performance-based ratemaking, and financial communication. We provide cost of capital analysis and expert witness testimony.

Strategic and Financial Advisory

A multi-dimensional transformation taking place today is fundamentally changing the ways in which electric, gas, and water utilities plan, operate and interface with their customers. Our clients are feeling the impacts from increased penetration of distributed energy resources, the wide variety of options for smart grid technologies, an evolving role for natural gas, complex regulatory requirements, and expanding customer expectations for new and innovative products and services.

Through our consulting assignments, MCR helps our clients navigate challenges and opportunities they face and understand them from an investor’s perspective and create opportunities to increase value for their customers, shareholders and other key stakeholders. We achieve this by developing customized strategies that are both manageable and executable.

Sam Brothwell, Vice President

Sam is Vice President of Strategic and Financial Advisory. Sam’s background includes a decade in utility industry corporate planning and investor relations, fifteen years on Wall Street as a senior equity and credit financial analyst and nearly a decade as a utility and pipeline investor. His background includes electricity, natural gas, and renewable energy. Sam has worked extensively with federal and state policy makers as well as non-government organizations involved in the energy and utility sectors, and he has spoken at numerous industry conferences and investment forums.

![]() Visit Profile

Visit Profile

GRE Transmission Incentive Order (Hot Topic)

More Transmission Incentives for Public Power and Cooperatives on the Horizon.

Read the Transmission Hot Topic

Is your EV strategy ready – yet?

Electric vehicles (EV) used to be something utilities thought of as on the horizon, but today they are very much here. The potential for significant increases in electricity sales is obvious, but EV also bring opportunities for enhanced customer engagement and experience. However, there are also considerable challenges related to infrastructure requirements to serve new EV loads, and how to manage or optimize the loads. Retail rates for charging, leasing chargers, charging subscriptions and customer-facing incentive programs function hand-in-hand to harness the opportunities and address the challenges.

MCR is providing a three-part series on EV for utilities, starting with conceptual and strategic issues, to be followed by a tariff-oriented paper and a client case study early in 2023.

Download the “Is your EV strategy ready – yet?” paper

Is your EV strategy ready – yet?

Electric vehicles (EV) used to be something utilities thought of as on the horizon, but today they are very much here. The potential for significant increases in electricity sales is obvious, but EV also bring opportunities for enhanced customer engagement and experience. However, there are also considerable challenges related to infrastructure requirements to serve new EV loads, and how to manage or optimize the loads. Retail rates for charging, leasing chargers, charging subscriptions and customer-facing incentive programs function hand-in-hand to harness the opportunities and address the challenges.

MCR is providing a three-part series on EV for utilities, starting with conceptual and strategic issues, to be followed by a tariff-oriented paper and a client case study early in 2023.

Download the “Is your EV strategy ready – yet?” paper

FRST® Software Demo

Transmission Inflation (white paper)

From 2018 through 2021, the average zonal network transmission rates (Schedule 9) within MISO rose by a compound annual growth rate (“CAGR”) of 9.6% per year compared to an average increase in the Consumer Price Index (“CPI”) of only 2.9% over that timeframe. Much of that increase occurred in 2021 when the MISO systemwide average zonal network rate rose by a stunning 17.7%1to $4.07 per kW/month compared to a CPI of 6.4%. In 2022, the MISO system average network rate rose by 5.2%2to $4.22 per kW/month whereas the CPI is currently running at 8.6% with core inflation at 6%,3levels not seen in four decades. The increases in MISO transmission rates over the years are from consistently high levels of transmission capital spending driven by numerous factors such as wind and solar development, NERC requirements, aging transmission facilities, and retirement of dispatchable power plants. As one transmission owner (“TO”) said, “every time you turn around, there is another reason to invest in transmission.” Now, there is another factor that can significantly raise transmission rates: inflation.

Read the details in our paper.

Upgrading Duquesne Light Company’s low income energy efficiency program tracking system

“MCR’s upgrade to the low income EE tracking system was delivered on time and on budget to significantly improve our staff and implementer efficiency, enhance our reporting capabilities, and modernize our cross-platform data exchanges.”

—Dave Defide, Senior Manager of Customer Programs

Background

Duquesne Light Company built its original low income energy efficiency (EE) tracking system decades ago in response to mandates for a Low Income Usage Reduction Program (LIURP) or “Universal Services” programs. Although the low income EE program was but one initiative in a portfolio of Universal Services programs to support income-eligible customers, the system was built primarily to track the low income EE program. Over time, changes to low income program mandates, designs, and delivery mechanisms caused the purpose-built system to no longer align optimally with the low income EE program compliance requirements, internal management needs, or the implementation process in the field. Furthermore, evolutions in information technology (IT), in particular database systems and interfaces between the low income EE tracking system and the core customer information system, left the current system approaching obsolescence and facing the end-date for underlying software and system support.

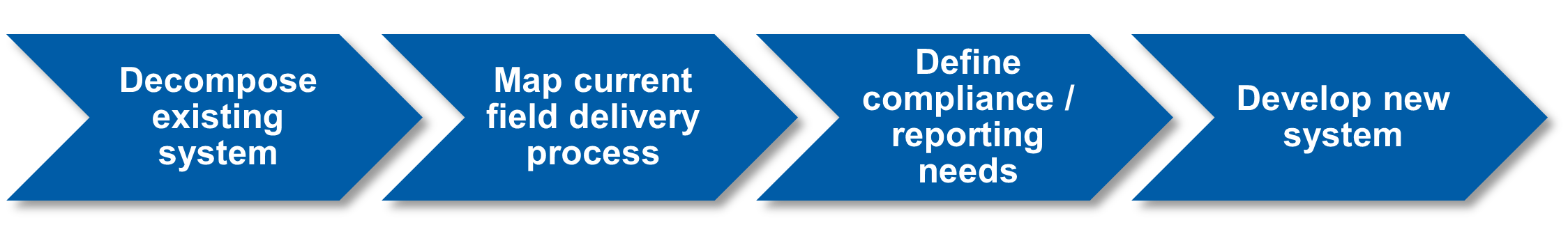

Solution

MCR applied our well-defined, structured approach to EE system planning to design a new system; then our utility-specific system development team developed the new system. Deploying the upgraded system without disrupting current implementation contractor scopes of work required replicating those parts of the existing system’s functionality that were still relevant, while bringing the look, feel, and self-service maintenance capabilities of modern systems to bear. A deep dive into compliance and other reporting and management analytic needs allowed the new system to align tightly with them, and to be capable of expansion to track and report one or more of the other Universal Services programs since their compliance, reporting, and internal management analytics needs are similar to those for the low income EE program.

Results

The system was completed in time for Duquesne Light to use it to support of the start of a new EE program year. Duquesne’s third-party implementation contractors were able to easily transition to the new system because it was designed to fit their processes and was similar to the systems they had been using. Duquesne management and staff now have a state of the art system featuring application programming interfaces to supporting systems and a variety of self-service maintenance capabilities. In addition, the system tightly aligns with program compliance requirements and fulfills Duquesne’s reporting needs, including those for management, analytical reporting, and evaluation, measurement, and verification (EM&V) purposes. Going forward, Duquesne will be able to easily expand the system to support additional Universal Services programs.

Upgrading Duquesne Light Company’s energy efficiency program tracking system

“MCR’s upgrade to the EE tracking system was delivered on time and on budget to significantly improve our staff and implementer efficiency, enhance our reporting capabilities, and modernize our web application infrastructure.”

—Dave Defide, Senior Manager of Customer Programs

Background

With the launch of a portfolio of demand-side management programs in response to the passage of Pennsylvania Act 129 of 2008, Duquesne Light Company built an energy efficiency (EE) tracking system to manage its portfolio of projects. More than a decade later, the original system continued to function as designed, but was increasingly difficult to maintain and inadequate for Duquesne’s evolving portfolio of programs. Changes in front- and back-end technologies and the pending retirement of legacy servers necessitated a system overhaul, but internal information technology (IT) resources were fully subscribed with other projects. Additionally, changes in program delivery shifted more activity from traditional downstream programs to mid- and upstream programs. This required better tracking of “bulk” measure data as it came to represent a larger and larger portion of program activity.

Solution

MCR applied our well-defined, structured approach (shown below) to EE tracking system design to understand the current system, specify a new system, then develop that new system using our utility-specific software development team. Throughout this process, the functional and technical teams worked closely together to ensure the needs and design considerations of both groups were incorporated into the project.

To deploy the new system without disrupting Duquesne’s statutorily required program delivery, MCR utilized a phased development and deployment approach that allowed the new system to launch on day one of a new multi-year program phase. This approach required developing an interim customer information retrieval mechanism but allowed the system to launch on time while Duquesne IT continued to work on a more sophisticated customer information application programming interface (API) service. After additional work alongside Duquesne’s IT team, a fully integrated system was deployed in a manner that was completely transparent to the end users.

Results

Duquesne Light went live with the new system on day one of Phase IV of PA’s Act 129 programs and now has a modern, cloud-hosted web application built in Angular and Microsoft SQL Server. Program implementation contractors quickly realized the benefits of additional mechanisms for bulk loading project data. Program management has also benefited from the new calculation engine and increased reporting and data export capabilities of the new system. These capabilities have increased automated compliance with calculation protocols and both the speed and accuracy of responses to internal data requests and regulatory reporting requirements.

Conducting a nationwide market scan to help a small gas utility chart a course for development of its first EE plan

Background

A small Mid-Atlantic gas utility had never run formal energy efficiency (EE) programs when legislation in one of its states required the utility to develop an EE plan, vet it through various stakeholder processes, and file it with the regulator. Being small and lacking EE experience, the client knew it did not want to start from scratch but also did not have sufficient knowledge of what gas EE programs were in the market already or what products and services these programs provided. The client called on MCR to help it build knowledge, understand its programmatic options, and chart a course toward potential development and filing of its first EE plan.

Solution

Given the client’s size, situation, and available budget, rather than lead the client down the usual path of undertaking an EE potential study and a program design process, MCR undertook a broad market scan to identify nationwide measures, incentive structures and levels, and program designs, which resulted in discovering 37 gas measures currently in the field. Program delivery structures included downstream, upstream, midstream, and direct install. A sample of these measures is in the table below:

| Gas EE Measures | |

|---|---|

| Furnace and boiler sizing, equipment and tune-ups | Water restriction devices |

| Per unit (therm, ccf, etc.) custom or performance-based incentives | Various heating and water heating system controls |

| Gas heating and water conversion | Programmable/WiFi thermostats |

| Gas-fired absorption heat pump | Commercial kitchen equipment |

| Infrared heating systems | Water heating systems |

| Various insulation and weatherization measures | Windows |

Results

MCR provided our client a clear understanding of the measure and program options currently being offered in the market. This, in turn, led the client to begin assessing what measures would be most beneficial and market-accepted by its customer base and what incentive levels and program types would best fit its budget. Once a direction is established, the client looks forward to engaging the state’s EE planning advisory stakeholder body with credibility and significant knowledge.

Achieving optimized funding through a value-based decision-making process

“The MCR team has been involved in building our value scoring acumen and helping us to standardize how we score projects across the fleet. Consequently, our engineers in nuclear score projects consistently and can explain variances to those scores.”

—Project Manager

Background

The nuclear division of a large southern utility was challenged with transitioning from subjective risk assessment to a value-based process for evaluating capital projects. The value-based process is supported with an industry-leading asset investment planning and management (AIPM) software solution, already implemented by other corporate divisions.

Every year, the corporate divisions competed for capital funding from an enterprise competition fund. However, this upcoming competition fund was to be awarded through the value-based framework under the new AIPM system. Our client had not implemented the system and was at a severe disadvantage in competing for nuclear project funding; they contacted MCR for help.

Solution

The MCR Nuclear Generation practice worked with our client’s business planning teams at both the corporate and site levels to rapidly implement the AIPM solution. We provided overall project management for the implementation, process mapped the current and future states and updated relevant long range planning processes and procedures. The MCR team configured the AIPM solution specific to nuclear industry needs and developed business cases for capital projects using the new value-based framework to compete for dollars from the enterprise competition fund.

Results

The project resulted in a successful implementation of the AIPM software, allowing for improved data-driven, value-based decisions in developing the overall project portfolio. In the first year of using the new software for the funding competition, the nuclear division successfully demonstrated the value of their projects which resulted in being awarded an additional $27M for their project portfolio from the competition fund.

Ian MacDougall, Consultant

Ian is a Consultant at MCR. He has over 15 years of experience in rates and regulatory affairs, energy efficiency, and revenue decoupling. His MCR experience includes the development of cost of service, revenue allocation, lead/lag studies, rate design, gas and electric energy efficiency programs, and testimony development. He also has prior experience at multiple gas and electric utilities managing and implementing rate design pilot programs, cost recovery mechanisms, revenue decoupling and unbundling procedures, and interrogatory response development.

![]() Visit Profile

Visit Profile

The New Infrastructure Investment and Jobs Act (white paper)

Transmission investment has been consistently strong across the country for many years. Despite high levels of transmission investment, the $1.2 trillion Infrastructure Investment and Jobs Act (“Infrastructure Act”) includes funding and programs designed to crank up grid transmission and distribution investment even higher, particularly when it comes to promoting interregional and interstate transmission. MISO and SPP could see incremental average annual transmission investment of approximately $410 million and $270 million, respectively. It is unclear whether all this spending will be truly incremental as some of the Act’s funding could end up being used for projects not yet designed but would have happened anyway, given the profitable nature of transmission investment. Nonetheless, if a small public power or cooperative utility happens to be the recipient of a grant or loan that prompts additional transmission investment, the impact could be a significant (albeit temporary) bump up in investment for that particular transmission owner.

Read the details in our Infrastructure Act paper.

MISO Transmission Rates in Joint Zones; Will the Transmission Rate Express Train Continue? (white paper)

MISO transmission rates have been rapidly escalating only to slow in recent years as transmission investment growth has moderated, the number of new transmission owners slowed, and the impacts of the corporate tax cut have played out. In 2021, however, MISO average transmission zonal rates increased by a stunning 17.7%, largely due to a 7.2% increase in transmission investment, a 4.1% decrease in load and the ending of deferred tax refunds. Looking to the next five years, MCR forecasts that zonal rates in joint pricing zones will increase by an average of 6.5% per year, well above the projected five-year inflation rate of 3.17%. We forecast that nine of the 20 joint pricing zones in MISO will see average annual rate increases over the next five years of at least 7%. These forecasted rate increases result from an expanding rationale for transmission investment as “resiliency” combines with social, political and regulatory changes; increasing capital, O&M and A&G costs due to rising inflation; and a continued hunger for earnings growth by IOUs and Transcos. The only way public power and cooperatives can protect their members and customers from the MISO “express train” of rising transmission rates is to develop a business plan to ramp up recoverable transmission investment that increases reliability, ensure no revenue is being left on the table by optimizing the transmission formula rate, and provide other transmission investing benefits to members and customers that make the impact of rising transmission rates more palatable.

Download the MISO Transmission Rates white paper.

Developing an energy efficiency KPI reporting process

Background

While managing day-to-day operations of a comprehensive portfolio of programs and preparing for a new filing with the Commission, the Energy Efficiency Manager of a Mid-Atlantic utility was tasked with reporting portfolio performance key performance indicators (KPIs) to senior management on a monthly basis. Some of these KPIs were straightforward and readily available in the existing energy efficiency (EE) tracking system. Others, however, were not explicitly tracked and required an analytic process to be developed to support monthly reporting. The most challenging of these KPIs was “participation,” as most tracking systems are built around EE measures, not on unique instances of participation. Based on MCR’s track record of successful engagements with the client over more than a decade, the Energy Efficiency Manager asked MCR for help.

Solution

MCR utilized our deep knowledge of our utility client’s data and systems to determine which KPIs could be derived analytically and if there were gaps in the existing data. Working with the client’s implementation contractors, MCR developed a monthly process of collecting additional data to fill those gaps. This process entailed automated email reminders and a web-based data collection form, which ensured consistent and validated data delivery.

Additionally, we established a set of analytic procedures to summarize the KPIs already in the tracking system and to calculate those derived synthetically. In order to improve efficiency and to ensure consistent results for these monthly reports, MCR developed this analytic process with the R programming language.1 Once the data has been collected from the implementation contractors and the EE tracking system, the analysis script need only be run for the full set of KPIs to be computed.

Results

By using our extensive knowledge of the industry, the client’s data system, and modern analytical tools, MCR was able to deliver accurate, monthly KPI metrics covering a number of reporting dimensions, including many that were not directly tracked by program management. The initial KPI report was developed and presented under a short deadline imposed by our client’s senior management in the context of many competing priorities. In addition, MCR was able to ensure consistent reports each month providing our client with high confidence in the results.

_______________

1 R Core Team (2021). R: A language and environment for statistical computing. R Foundation for Statistical Computing, Vienna, Austria. URL https://www.R-project.org/

Helping an energy efficiency program continue successfully during COVID

“Our partnership with MCR over the past decade has been exceptional and the success of this program during a very difficult time speaks to the high quality and innovative nature of what could have been a very rough year.”

—Senior Manager of Customer Programs

Background

A mid-Atlantic utility selected MCR Performance Solutions, LLC (MCR) by competitive solicitation to implement a Public Agency Partnership Program (PAPP) and a Community Energy Efficiency Education Program (CEEP). The performance period started in 2016 and ended in 2021. MCR implemented both programs by providing program marketing, participant enrollment, program materials, project development and engineering services as well as facilitating project meetings, training, and logistical support.

In March 2020, the COVID-19 pandemic disrupted business leading to full or partial closure of educational and governmental institutions across the utility’s service territory. MCR’s implementation of the PAPP and CEEP programs was also interrupted. At that time, on-the-ground PAPP implementers observed unoccupied buildings with onsite operational and maintenance staff who suddenly had a much lighter workload due to workers/students not being able to use the premises.

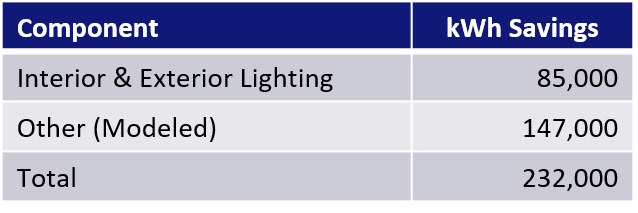

Solution

MCR proposed, and the utility authorized, a PAPP Directed Self-Install program to retrofit these unoccupied buildings by providing energy efficient lighting at no cost, if participating customers agreed to install the products within 30 days. Key to the initiative, MCR negotiated the bulk purchase of Design Lights Consortium approved fluorescent lamp replacement LEDs with unit cost at or near the original rebate program unit incentive amount. As we began to implement the program, MCR observed a high interest in the supply chain suppliers to provide the LED lighting products. We also experienced a high degree of interest in the program by the utility’s customers.

Results

Program launch was instantaneous and PAPP transitioned from an implementation fractured by a global pandemic to recording one of its strongest years in recent history. Over the 13 months of this program, MCR helped place over 220,000 4-foot LED lamps at over 100 customer sites. For the “CV-19 Lamps,” MCR reported almost 8,000 MWh savings, independently verified (to-date) at 130% with a Total Resource Cost (TRC) test cost-benefit ratio greater than 4.0:1.

Life After Lighting: How Utilities Should Retool Their Energy Efficiency Portfolios (white paper)

Recently, there has been federal activity at the Department of Energy (“DOE”) regarding general service lighting (“GSL”), the Energy Independence and Security Act (“EISA”) efficiency standard, and the 45 lumen per watt backstop for GSL. This activity creates for a timely opportunity for MCR to revisit standards, lighting, and “Life After Lighting” for utilities and their EE programs. In a new, short paper we share:

- What actions DOE has taken recently

- The situation with respect to lighting within utility EE portfolios

- A brief review baselines and standards, using lighting as an example

- Recommendations and MCR’s framework for acting on them

Download the paper on life after lighting

Developing a transmission formula rate and protocols for a transmission developer (Transmission Formula Rate Analysis)

Background

A transmission developer participated in a public policy-based solicitation process and was awarded a segment of a very large transmission line project. The project represented the developer’s entrance into the RTO, which required a new formula rate and protocols. The transmission developer engaged MCR to develop and support the formula rate and protocols at FERC.

Solution

MCR reviewed documents from the project approval process and participated in discussions with the client team to understand the cost elements and terms for the recovery of the project’s costs. The formula rate was then designed and developed to ensure recovery of all allowed costs and the proper calculation of each rate component, including the inclusion of return on equity incentives granted to the client. MCR worked with the client and outside counsel to develop and finalize the associated transmission owner protocols.

Results

MCR’s expertise and management of the formula rate’s development ensured that the cross-functional client team members were in alignment with the calculation of costs included in the formula rate. The formula rate was tested to successfully recover all approved costs and the protocols were approved by outside counsel. MCR’s testimony in support of the formula rate and protocols went unchallenged throughout the FERC Section 205 filing; and the client gained approval for the formula rate.

Helping a large gas utility implement COST™ to allow in-house development of cost of service and rate design

Background

A large gas utility serving over 750,000 customers wanted to purchase a study to run scenarios in house. They also had a desire to be able to run scenarios in two other jurisdictions for rate cases.

The utility engaged MCR to develop the Cost of Service Tool (COST™) to enable the utility to run these scenarios in-house. Ultimately the client wanted to run the model in future proceedings for their rate proceedings and special studies.

Solution

MCR developed their COST™ model using the client’s revenue requirements as an input and created the study as well as integration into the rate design. MCR also provided expert testimony for the rate case regarding the COST™ model and associated rate design. Hands-on training and documentation were provided to the company for their use in the future.

Results

The COST™ model took direct feed from the financial records and revenue requirements model to create an in-house model that was used in a current rate case. At the client’s direction, the COST™ model has the capability to be used in future rate cases in the same jurisdiction as well as two other jurisdictions in which they provide service. Having an in-house model allows the client to continue to use and customize it, freeing them of using consultants on a long-term basis.

Helping a water conglomerate utilize COST™ to achieve budget forecasts in multiple territories

Background

A large water company needed a Cost of Service model to provide full details over 20 jurisdictions and to easily expand when additional properties were acquired.

The conglomerate’s individual territories and acquired companies each had unique models that could not be directly compared to each other. Analysts had to spend valuable time learning each model in order to cross-train with the other areas.

The utility engaged MCR to provide a solution allowing for a single model to be used throughout the company’s 20+ jurisdictions.

Solution

To implement the Cost of Service Tool (COST™), MCR developed a revenue requirements model, complete with standard filing schedules for water and wastewater that could be adapted, as needed, to each jurisdiction’s specific requirements while maintaining a single model’s programming.

The model’s revenue requirement feature also allowed the company to develop a forecast for a 2-year budget throughout its territories.

Results

The COST™ model’s easily adaptable formulas and layout allowed the company to have a singular model for various territories.

Helping an investor-owned electric utility implement COST™ to achieve greater cost transparency

Background

An investor-owned utility was involved in a complex rate case involving significant shifts in rate structure across all classes. The initial Cost of Service filing was prepared using a database tool that provided output without the underlying logic.

Intervenors and commission staff expressed frustration with their lack of access to the underlying logic of the model. The issue became more pronounced as the potential outcomes of the rate case included new rate schedules and a unique proposal to address net metering issues.

The resulting rate order included a provision for the company to adopt a more transparent Cost of Service model.

The utility engaged MCR to provide a solution allowing for robust, error-free modeling of the Cost of Service while providing third parties the access they were promised via the rate order.

Solution

To implement the Cost of Service Tool (COST™), MCR made use of its proprietary mapping tool, which meant minimal changes to the client’s existing datasets. MCR was then able to quickly roll-out COST™, providing an accurate Cost of Service model with the flexibility needed for unknowns of the future.

The built-in scenario capability met third party needs to test alternative allocations and adjustments while ensuring an accurate result. MCR provided the client a separate tool enabling comparison of multiple alternatives.

Results

COST™ supported the utility for its most recent rate case. The flexible architecture allowed for a series of last-minute changes required by the process and ensured a timely submittal.

Cost of Service Tool (brochure)

The Cost of Service Tool (COST™) is the newest addition to MCR’s suite of spreadsheet applications. COST™ is ideal for regulatory professionals seeking to provide greater transparency to regulators, intervenors and other stakeholders. The modeling tool also provides flexibility for in-house scenario analysis and rate design options. Built in Microsoft Excel, COST™ is a fully functional cost of service model with open logic for audit, review and user editing.

Download our COST™ brochure to learn more about the product that adds value to our clients.

Download our IT support requirements for COST™.

Cost of Service Options

MCR works with our clients to determine the best approach to cost of service. We offer a few options for rolling out our Cost of Service Tool (COST™), including licensing the model along with additional consulting support. Download our brief overview, Cost of Service Options for Utilities, to learn more about these alternatives.

Conducting a review of a transmission formula rate (Transmission Formula Rate Analysis)

“The improved cost recovery from the Attachment O Review is a windfall

for us … the return on investment was immediate and substantial.”—GM, municipal utility

Background

The general manager of a MISO transmission-owning municipal electric utility saw an MCR conference presentation and became interested in MCR’s Attachment O formula rate services. The general manager engaged MCR to make sure the utility was properly recording its costs and optimizing its transmission revenue in its existing transmission formula rate.

Solution

MCR conducted a review of the municipal’s Attachment O formula rate costs, associated work papers and its detailed general ledger accounts. MCR supplemented the review of costs with interviews of key operating and financial personnel to understand their day-to-day activities. These two steps ensured the client was recording its distribution and transmission assets and expenses consistent with the FERC Uniform System of Accounts and the MISO tariff. Along the way and also in a workshop setting, MCR provided education regarding the proper recording of costs and the optimization of allocators used in the Attachment O.

Results

The Attachment O Review resulted in improvements to how certain costs were recorded and led to modified timekeeping processes to ensure costs were recorded consistent with FERC accounting. The client achieved a substantial increase in annual transmission revenue by placing its existing transmission-related expenses in the proper categories and ensuring field personnel were charging the proper accounts, with a particular emphasis on the appropriate recording of transmission vs. distribution wages. The additional annual revenue eased budget concerns, helping the client to fund additional necessary capital projects. The Attachment O Review also resulted in a more educated and confident staff that now has an in-depth understanding of Attachment O related assets and expenses and how allocators impact revenue, providing staff with the ability to make more informed business decisions going forward.

Utility Financial Modeling: Spreadsheets Can Deliver Results (point of view)

Financial and regulatory analysts working at utilities understand the need for utility-specific models as the unique challenges of utility forecasting cannot be shoehorned into a model built for other types of businesses. No other industry requires the type of logic needed to translate forecasts of expense, revenue and capital investment into an integrated whole while providing insight into the business. Whether its earnings forecasts for investor-owned utilities or financial metric analysis and rate forecasts for public and cooperative entities, forecast groups must provide models that generate reliable and defensible answers. Modeling for utilities is complex, leading some analysts to believe that the complexity does not lend itself to spreadsheet modeling. But advances in technology and modeling practices make spreadsheets a superior choice for both accuracy and flexibility.

Download the MCR Point of View.

The Four Reasons Why Battery Storage Will Gain Traction in MISO and SPP (white paper)

In 2021, front of the meter utility-scale battery storage will continue to grow rapidly in certain states and will begin to make a significant difference in some wholesale markets, most notably the California ISO (“CAISO”). By contrast, even though the interconnection queues for storage have been increasing in size in MISO and SPP, the practical impacts of battery storage are not likely to be reflected in these wholesale markets for the next few years. By 2025, however, MISO and SPP will join CAISO in experiencing widespread adoption of storage. Once growth starts accelerating in MISO and SPP, it will be very difficult to keep up and meet both the opportunities and challenges that lie ahead if utilities are not prepared.

Download the Battery Storage white paper.

MCR Transmission Strategy Services (brochure)

MCR helps G&T cooperatives, municipals, public power districts and joint action agencies in SPP and MISO realize the full revenue potential from their transmission assets. We use a collaborative approach for all our transmission engagements with the goal of finding and generating value for our clients. Download our brochure to learn more about the services that add value to our clients.

Download the MCR Transmission Services Brochure

Achieving Significant O&M Reduction with Risk Informed Budgeting (white paper)

The utility industry is undergoing dramatic change as new technologies, such as solar and batteries, threaten to disrupt the traditional utility generation model and may have a dramatic impact on revenues. At the same time, costs are increasing as interest rates rise, distribution systems are reworked to adopt two-way flow of power, and customer expectations drive the need to support new channels for information and transactions. Combined, these trends are placing significant pressure on earnings.

To address these pressures, utilities frequently look to traditional cost cutting methods to meet financial performance objectives: flat percentage or across-the-board cuts in base budgets, staff reduction or deferred project spending. While these traditional methods may achieve some results, a more analytical approach to optimize spending will help ensure the right funding is applied to the right efforts at the right time.

Risk Informed Budgeting is an analytical approach to budgeting where the timing, amount and consequence of every budget line item is challenged. In our experience, an effectively implemented Risk Informed Budgeting program can produce 10% to 15% savings in routine budgets, even after implementing other cost reduction initiatives.

Read the Risk Informed Budgeting white paper

Helping a generation business unit optimize preventive maintenance projects during an outage

Background

A generation business unit was planning the maintenance outage scope for its nuclear plant and had an extensive list of Preventive Maintenance projects as candidates for inclusion in the outage plan. Given the high cost of having the plant offline for maintenance work, the generation business unit was considering Preventive Maintenance Optimization (PMO) to optimize the number of Preventive Maintenance projects (PM) undertaken at its nuclear plant during the outage. Knowing that many PMO efforts are challenging to perform, lack the bases to change PM labor burdens and may even create more PM work orders, the generation business unit reached out to MCR for help.

Solution

MCR used our proprietary categorization approach based on management’s ability to influence the scope and/or schedule of each PM. Our categorization approach incorporated documented requirements, evidence of asset performance plus consideration of risk attributed to scope and schedule determinations.

All PMs were reviewed as if no frequency currently existed, establishing a recommended frequency for the very first time. PMs were grouped according to the plant equipment hierarchy where possible with operational consideration given to every PM. MCR then made recommendations based on our risk-informed methodology where consideration was given to the probability of an adverse consequence as an outcome of establishing PM scope and periodicity. All information was presented and reviewed in workshops with Engineering asset owners to identify any special circumstances for any PM.

Results

The project produced a matrix of all PMs in outage scope with current PM information and other valuable data including:

- Categorization of each PM based on management’s ability to influence scope or schedule

- Potential consequence related to reducing the PM burden

- Probability of the consequence occurring

- Information sources and references supporting recommendations

- Measure of Engineering support for each recommendation

The project discovered information necessary to establish proper PM scope and schedule and fostered ownership of PM recommendations by the individual asset owners. The combination of improved labor estimates reducing overall labor cost plus condition-based adjustments of PM next due dates identified potential savings of more than $2M for a single maintenance/refueling outage.

The Age of Alternative Ratemaking (paper)

The use of Alternative Ratemaking Mechanisms (“ARM”) is not a new concept. Yet, despite its solid record of being beneficial to utilities, regulators, and stakeholders, it has historically had a slow level of adoption by many states. That has now changed, and we are entering a new regulatory age: The Age of ARM. Even states that have been extremely reticent to shift away from the traditional rate design methodology are now moving to embrace the use of alternative ratemaking. Whether or not your state has adopted the use of ARM, it is important to consider ways in which these mechanisms could create both opportunities and challenges.

Environmental Advocates Have Proposed a Sweeping New Approach to Regulating Utility Capital Investments and Earnings (News Alert)

On August 19, 2020, the organization E4TheFuture, whose mission is to “promote residential clean energy and sustainable resource solutions to advance climate protection and economic fairness by influencing… policies,” released a new publication titled, “National Standard Practice Manual for Benefit-Cost Analysis of Distributed Energy Resources” (“NPSM for DER”). Under the direction of E4TheFuture, advocacy-oriented firms such as Synapse Energy Economics and Energy Futures Group, as well as the agenda-driven Smart Electric Power Alliance, authored this manual. E4TheFuture is working with regulatory commissions and other stakeholders to encourage adoption of the ideas presented in the NSPM for DER; if embraced by policy and regulatory actions, the NSPM for DER will dramatically affect how electric and gas utilities plan, make investments and create earnings.

MCR’s Cost and Rate Competitiveness Services (brochure)

Click here to download the Cost and Rate Competitiveness Services brochure

MCR provides transmission strategy support to municipals, public power districts, joint action agencies, G&Ts, T&D cooperatives, and independent transmission developers in various RTOs. Our clients have a goal of optimizing the value of their current and future investments in electric transmission. We help them understand their costs and realize the full revenue potential from these transmission assets. MCR’s Transmission Strategy practice provides the following services:

Transmission Cost/Rate Competitiveness (see earlier pages for more detail)

- Peer Cost Comparison by FERC Account

- Rate Strategy and Transmission Revenue Forecasting

- Transmission Capital Investment and Metric Comparisons

Transmission Formula Rate Analysis

- Formula Rate Review for Existing Transmission Owners

- Development of ATRR for New Transmission Owners

- Review/Challenge to Incumbent IOU Formula Rate Costs

- Staff Education Workshops on Transmission Formula Rates

FERC Filings

- Section 205 Rate Filings – Testimony and Formula Rate Support

- Transmission Incentive Rate Filings and Testimony

- Cost of Capital Expert Testimony

- Intervention and Settlement Support

Strategic Economic Analysis

- Analysis of Joint Zone Investment and FERC 7-Factor Test

- Analysis of Potential Purchase or Sale of Transmission Assets

- Economic Evaluation of New Transmission Projects

- RTO Membership Evaluation

- Development of Transmission Business Plans

The Seven Potential Threats to the Transmission Business: Is Transmission in SPP Still a Solid Business? (white paper)

Over the past decade, the transmission business has been lucrative for most transmission owners in SPP transmission. Transmission investment has been a driver of earnings growth for investor-owned utilities (“IOUs”) and transmission companies (“Transcos”), while providing high returns for public power and cooperatives. On the horizon, however, there are numerous potential threats to the transmission business and to transmission owners’ ability to sustain high levels of new investment. MCR believes that although some of these threats may eventually have an increasing impact on future investment opportunities, there are factors that mitigate these threats. Transmission will continue to be a strong business in SPP through at least the mid-2020s.

Download the Threats to Transmission Business white paper.

Helping Duquesne Light Company design and implement energy efficiency programs to meet its Pennsylvania Act 129 obligations over three multi-year phases

Background

Signed into law by Governor Ed Rendell in 2008, Pennsylvania Act 129 required Duquesne Light Company, and other electric distribution companies in Pennsylvania, to develop cost effective plans that would reduce electricity consumption across their service territory by one percent by 2011 and three percent by 2013. In order to meet these requirements and as a result of a competitive bid process, Duquesne Light selected MCR to design and implement an energy efficiency and demand response plan.

Solution

MCR worked with Duquesne Light to develop an energy efficiency potential forecast and create a portfolio of 17 energy efficiency and demand-response programs serving the residential, low income, commercial, industrial and governmental customer sectors. The programs were designed and benchmarked to best practices to achieve savings in the market segments identified by the potential forecast.

Working with the regulatory and legal teams, we developed the filing and expert testimony for the Phase I plan and participated in interactions with the Pennsylvania Public Utility Commission (PUC or Commission). After the Commission approved the plan, we helped the client’s energy efficiency department develop operational processes and supporting systems; assisted with the solicitation, evaluation and selection of program implementation contractors; and interacted with the statewide evaluator and EM&V consultant to address evaluation, measurement and verification matters.

Results